The Timeless Appeal of Vertical SaaS

By: Javier Valverde, Investor at Prosus Ventures

Over the past decade, we have seen the increasing success of software solutions focused on specific industries, Veeva (pharma), ServiceTitan (home services), Procore (construction), Toast (restaurants) and Mindbody (gyms).

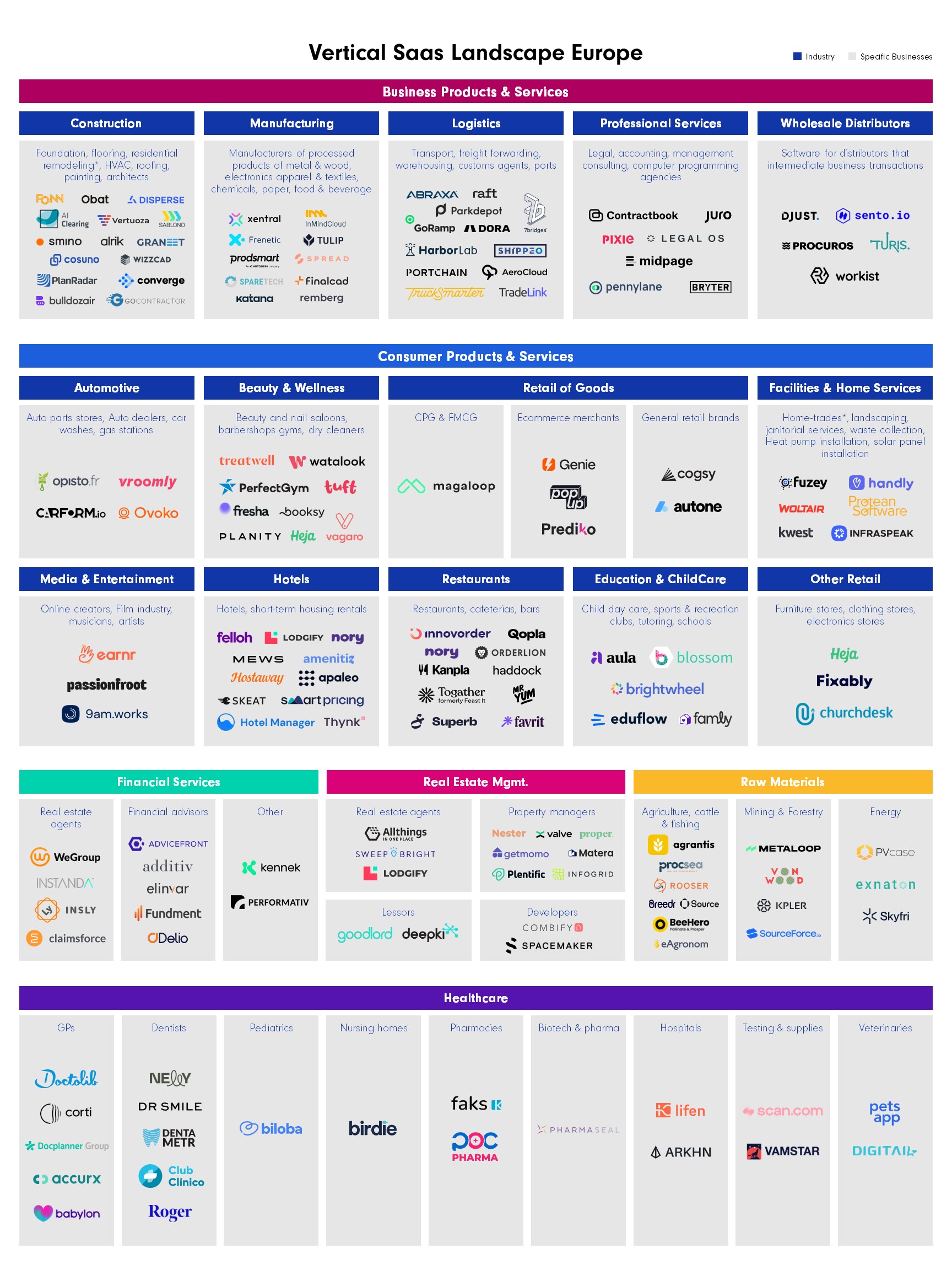

Industry-specific software, ‘Vertical SaaS’, has a lot of opportunities going forward, and new AI advancements are an accelerant on this stack (‘Vertical AI’). We have seen U.S. company mappings of Vertical SaaS startups, but no attempts at a comprehensive mapping of Europe Vertical SaaS, therefore in this article we will share a European mapping.

But first, for those building in the space, what elements can make a good industry for building a large vertical SaaS business? While each industry potential should be evaluated independently, the most generalizable factors are: 1). Large end-markets. E.g. there are 124,000 dentist companies in the US, making $126bn in revenue annually and 2). Some level of fragmentation. E.g. top 50 dentist companies only make up 7% of total industry sales, meaning most of the market is not controlled by a set of large companies.

Based on the US census, we analyzed the size and fragmentation of over 1,000 industries to identify potentially fertile spaces for vertical SaaS to flourish. Industries that are large and fragmented.

Successful companies can be built in any of the above three dotted circles, but there are common pitfalls to watch for in each:

The SMB SaaS ‘Goldilocks Zone’ (top right) includes industries like restaurants, building contractors, or law firms.

- Upside: Industries that are both large in customers and fragmented in concentration create pricing power with a large TAM.

- Downside: Due to its more attractive structure, some of its verticals may find more competition from startups or incumbents. For instance, the restaurant segment has strong incumbents like Toast, and the home services segment has ServiceTitan. In addition, very fragmented industries can have SMBs with low annual contract values, which may need an adapted go-to-market.

- The opportunity: Companies may find opportunities here through regional-specific plays (e.g. building the Toast for Middle East) or by further specializing within a vertical (e.g. Roofr specialized within a subsegment of construction contractors: roofing contractors).

The more specialized market ‘Happy Medium’ (top left) includes industries like auto dealers, machinery wholesalers, or veterinaries.

- Upside: These categories of SaaS tend to have lower competition historically, so the software being displaced can be antiquated or not purpose-built for the industry. Therefore, the bar to add value can be lower.

- Downside: A possibility of small TAMs. It’s important to ensure that the SaaS and expansion opportunities allow for the building of a large enough business. In this bucket, the ‘layer cake’ approach can be more important.

- The opportunity: The new infrastructure in fintech can lead to more monetization, while AI allows for software creation with less resources and higher workflow automation. This may enable SaaS companies to capture more value earlier on (a higher take rate on industry size), and may make smaller verticals attractive for venture investment.

The large customer-dominated ‘Enterprise District’ (bottom left) includes industries like oil refineries or telecoms.

- Upside: Larger customers can lead to bigger contracts and also tend to have higher retention than smaller ones.

- Downside: Given the size of larger customers, there can be longer sales cycles. Additionally, an aversion from larger companies to work with startups can pose a challenge to growth.

- The opportunity: The opportunity with large enterprise dominated sectors may require a different approach. Large enterprises often already have a System of Record (SOR - see below for more detail), for many it is their ERP system. As such, the opportunity may lie in building specific high value workflows on top of the existing system of record.

We have been meeting with founders globally who are building industry-specific workflows. Below, we’ve highlighted some of these companies who are in Europe. We tried to be exhaustive, but if we’ve missed you or if you know someone building a Vertical Saas / Vertical AI company, please reach out (Javier.valverde@prosus.com), I look forward to hearing from you.